Thin-Film Nanomanufacturing in 2025: How Disruptive Technologies and Surging Demand Are Reshaping the Industry. Explore Market Growth, Breakthroughs, and Strategic Opportunities for the Next Five Years.

- Executive Summary: Key Findings and Strategic Insights

- Market Overview: Defining Thin-Film Nanomanufacturing in 2025

- Industry Growth Forecasts (2025–2030): Market Size, Segments, and 18% CAGR Analysis

- Technology Landscape: Current State and Emerging Innovations

- Key Applications: Electronics, Energy, Healthcare, and Beyond

- Competitive Analysis: Leading Players, Startups, and M&A Trends

- Regional Dynamics: North America, Europe, Asia-Pacific, and Rest of World

- Supply Chain and Manufacturing Challenges

- Investment Trends and Funding Landscape

- Regulatory Environment and Standards

- Future Outlook: Disruptive Trends and Strategic Recommendations (2025–2030)

- Sources & References

Executive Summary: Key Findings and Strategic Insights

Thin-film nanomanufacturing represents a transformative approach in the fabrication of materials and devices at the nanoscale, enabling advancements across electronics, energy, healthcare, and more. In 2025, the sector is characterized by rapid technological innovation, increased investment, and expanding application domains. Key findings indicate that the integration of advanced deposition techniques—such as atomic layer deposition (ALD), molecular beam epitaxy (MBE), and chemical vapor deposition (CVD)—is driving improvements in film uniformity, scalability, and material performance. These methods are being adopted by leading industry players, including Applied Materials, Inc. and Lam Research Corporation, to meet the stringent requirements of next-generation semiconductors and flexible electronics.

Strategically, the convergence of thin-film nanomanufacturing with artificial intelligence (AI) and machine learning is optimizing process control and defect detection, reducing production costs and time-to-market. This digital transformation is supported by collaborations between manufacturers and technology providers, such as International Business Machines Corporation (IBM), which are leveraging AI-driven analytics for predictive maintenance and yield enhancement.

Sustainability is emerging as a critical driver, with companies prioritizing eco-friendly materials and energy-efficient processes. Initiatives led by organizations like SEMI are fostering industry-wide standards for green manufacturing, while regulatory frameworks in the European Union and Asia-Pacific are accelerating the adoption of low-impact chemistries and recycling protocols.

The competitive landscape is marked by strategic partnerships, mergers, and acquisitions, as firms seek to expand their technological capabilities and global reach. Notably, collaborations between equipment suppliers and research institutions, such as those involving imec, are accelerating the commercialization of novel thin-film materials, including 2D semiconductors and organic-inorganic hybrids.

In summary, thin-film nanomanufacturing in 2025 is defined by technological convergence, sustainability imperatives, and dynamic industry collaboration. Stakeholders who invest in advanced process technologies, digital integration, and sustainable practices are poised to capture significant value as the market continues to evolve and diversify.

Market Overview: Defining Thin-Film Nanomanufacturing in 2025

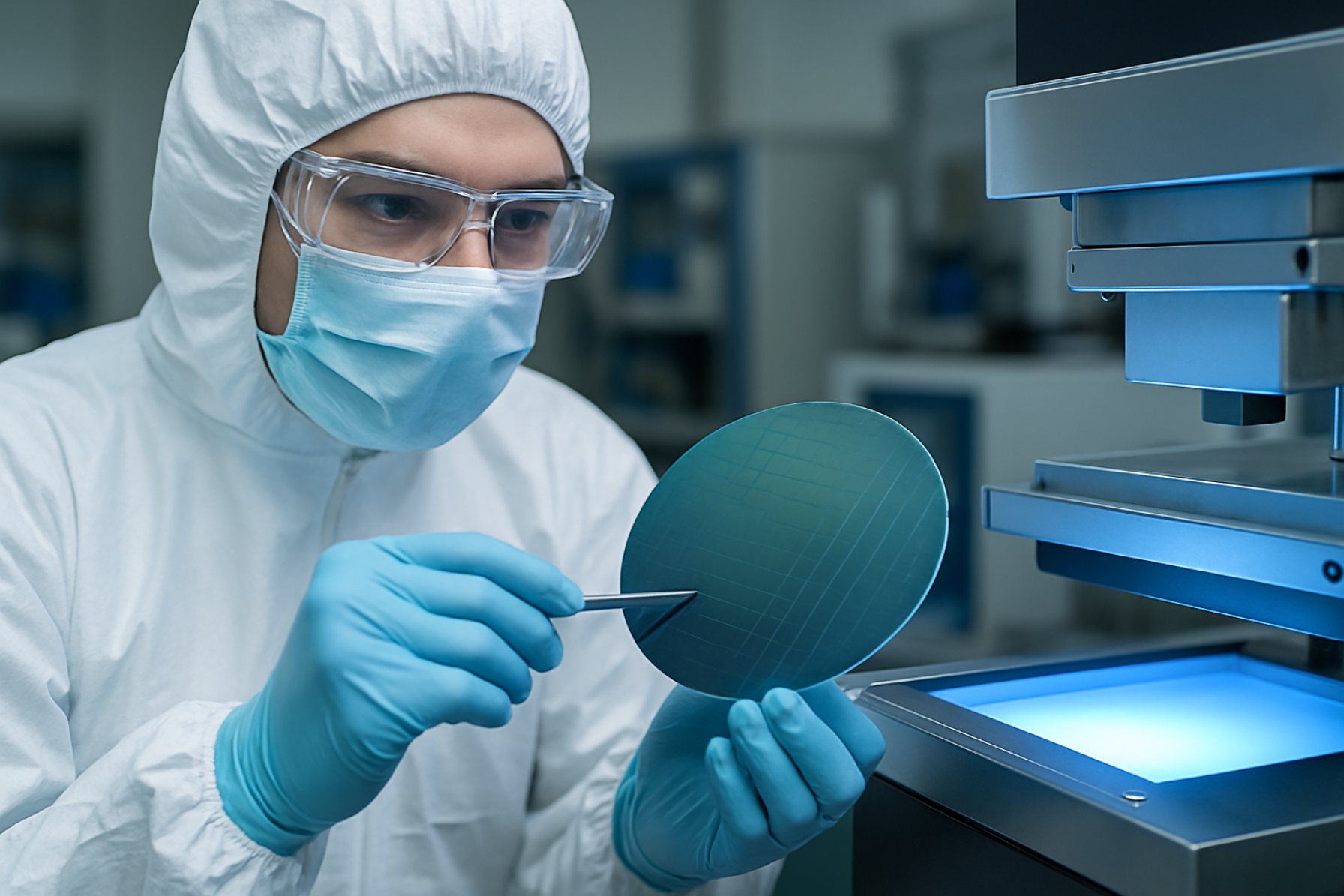

Thin-film nanomanufacturing refers to the precise fabrication of materials with thicknesses typically ranging from a few nanometers to several micrometers, using advanced deposition and patterning techniques at the nanoscale. By 2025, this field is characterized by its pivotal role in enabling next-generation electronics, energy devices, and biomedical applications. The market is driven by the demand for miniaturized, high-performance components, particularly in sectors such as semiconductors, flexible displays, photovoltaics, and sensors.

Key processes in thin-film nanomanufacturing include physical vapor deposition (PVD), chemical vapor deposition (CVD), atomic layer deposition (ALD), and molecular beam epitaxy (MBE). These methods allow for the controlled layering of materials with atomic precision, essential for the fabrication of advanced integrated circuits and optoelectronic devices. Companies like Applied Materials, Inc. and Lam Research Corporation are at the forefront, supplying equipment and process solutions that enable high-throughput, cost-effective production.

In 2025, the thin-film nanomanufacturing market is shaped by several trends. The proliferation of 5G technology and the Internet of Things (IoT) is accelerating the need for smaller, more efficient chips and sensors. Simultaneously, the push for renewable energy is boosting demand for thin-film solar cells, with manufacturers such as First Solar, Inc. leveraging nanomanufacturing to enhance efficiency and reduce costs. In the biomedical sector, thin-film coatings are increasingly used for drug delivery systems and implantable devices, supported by innovations from organizations like Medtronic plc.

Geographically, Asia-Pacific remains the dominant region, driven by robust investments in semiconductor manufacturing in countries like South Korea, Taiwan, and China. North America and Europe continue to invest in R&D and advanced manufacturing capabilities, supported by initiatives from entities such as SEMI, which fosters global industry collaboration.

Overall, thin-film nanomanufacturing in 2025 is defined by rapid technological advancements, expanding application areas, and a competitive landscape shaped by both established players and innovative startups. The sector’s evolution is closely tied to the broader trends of digitalization, sustainability, and healthcare innovation.

Industry Growth Forecasts (2025–2030): Market Size, Segments, and 18% CAGR Analysis

The thin-film nanomanufacturing industry is poised for robust expansion between 2025 and 2030, with forecasts projecting a compound annual growth rate (CAGR) of approximately 18%. This surge is driven by escalating demand across sectors such as electronics, renewable energy, medical devices, and advanced coatings. The market size, valued at several billion USD in 2024, is expected to more than double by 2030, reflecting both technological advancements and the proliferation of applications leveraging thin-film nanotechnologies.

Segment-wise, the electronics sector remains the dominant force, fueled by the ongoing miniaturization of semiconductors, sensors, and display technologies. Companies like Samsung Electronics Co., Ltd. and Intel Corporation are investing heavily in next-generation thin-film transistors and memory devices, which are critical for high-performance computing and mobile devices. The renewable energy segment, particularly thin-film photovoltaic cells, is also witnessing accelerated growth, with organizations such as First Solar, Inc. advancing cadmium telluride (CdTe) and copper indium gallium selenide (CIGS) technologies to improve efficiency and reduce costs.

Medical and life sciences applications are another high-growth segment, as thin-film coatings enable the development of biocompatible implants, drug delivery systems, and diagnostic devices. Companies like Medtronic plc are exploring nanostructured thin films for enhanced device performance and patient outcomes. Additionally, the automotive and aerospace industries are adopting thin-film nanomanufacturing for lightweight, corrosion-resistant coatings and advanced sensor integration, with support from organizations such as The Boeing Company.

Geographically, Asia-Pacific is expected to maintain its leadership, driven by significant investments in manufacturing infrastructure and R&D, particularly in China, South Korea, and Japan. North America and Europe are also projected to experience substantial growth, supported by strong innovation ecosystems and government initiatives promoting advanced manufacturing.

Overall, the 18% CAGR forecast for 2025–2030 underscores the transformative potential of thin-film nanomanufacturing. As industry players continue to innovate and diversify applications, the market is set to play a pivotal role in shaping the future of high-tech manufacturing and sustainable technologies.

Technology Landscape: Current State and Emerging Innovations

Thin-film nanomanufacturing represents a cornerstone of modern materials engineering, enabling the fabrication of ultra-thin layers—often just a few nanometers thick—on a variety of substrates. As of 2025, the technology landscape is marked by both the maturation of established deposition techniques and the rapid emergence of novel processes that promise to redefine performance and scalability.

Traditional methods such as physical vapor deposition (PVD), chemical vapor deposition (CVD), and atomic layer deposition (ALD) remain widely used for producing high-quality thin films with precise control over thickness and composition. These techniques are integral to industries ranging from semiconductors to photovoltaics and flexible electronics. For instance, Applied Materials, Inc. and Lam Research Corporation continue to advance PVD and ALD platforms, focusing on improved uniformity, throughput, and compatibility with next-generation materials.

Emerging innovations are reshaping the thin-film nanomanufacturing landscape. Roll-to-roll (R2R) processing, for example, is gaining traction for its ability to produce large-area flexible films at industrial scale, a key enabler for applications like wearable electronics and advanced displays. Companies such as 3M Company are investing in R2R systems that integrate nanocoating and patterning steps, reducing costs and expanding design possibilities.

Another significant trend is the integration of machine learning and artificial intelligence into process control. By leveraging real-time data analytics, manufacturers can optimize deposition parameters, predict defects, and accelerate the development of new materials. International Business Machines Corporation (IBM) and other technology leaders are pioneering AI-driven platforms for thin-film process optimization.

Material innovation is also at the forefront. The development of two-dimensional (2D) materials, such as graphene and transition metal dichalcogenides, is opening new avenues for ultra-thin, high-performance films with unique electrical, optical, and mechanical properties. Research collaborations between industry and academia, including initiatives by Samsung Electronics Co., Ltd., are accelerating the commercialization of these advanced materials.

In summary, the current state of thin-film nanomanufacturing is characterized by a blend of established precision techniques and disruptive innovations. The convergence of scalable manufacturing, intelligent process control, and novel materials is poised to drive the next wave of breakthroughs across electronics, energy, and healthcare sectors.

Key Applications: Electronics, Energy, Healthcare, and Beyond

Thin-film nanomanufacturing has become a cornerstone technology across multiple industries, enabling the creation of materials and devices with unprecedented precision and functionality. Its versatility stems from the ability to deposit, pattern, and manipulate materials at the nanometer scale, leading to significant advancements in electronics, energy, healthcare, and other sectors.

- Electronics: Thin-film nanomanufacturing is integral to the production of semiconductors, displays, and sensors. Techniques such as atomic layer deposition and molecular beam epitaxy allow for the fabrication of transistors and integrated circuits with ever-shrinking feature sizes, supporting the ongoing miniaturization and performance improvements in consumer electronics. Companies like Intel Corporation and Samsung Electronics rely on advanced thin-film processes to manufacture next-generation chips and memory devices.

- Energy: In the energy sector, thin-film nanomanufacturing enables the development of high-efficiency photovoltaic cells, batteries, and fuel cells. Thin-film solar technologies, such as those pioneered by First Solar, Inc., utilize nanostructured layers to enhance light absorption and conversion efficiency while reducing material costs. Additionally, thin-film coatings improve the performance and longevity of battery electrodes and electrolytes, supporting the growth of renewable energy storage solutions.

- Healthcare: The healthcare industry benefits from thin-film nanomanufacturing through the creation of advanced diagnostic devices, drug delivery systems, and biocompatible coatings. For example, Medtronic plc employs thin-film technologies in implantable sensors and medical devices, enabling minimally invasive procedures and real-time health monitoring. Nanostructured films also facilitate targeted drug delivery and controlled release, improving therapeutic outcomes.

- Beyond: Advanced Materials and Emerging Fields: Beyond these core sectors, thin-film nanomanufacturing is driving innovation in areas such as flexible electronics, smart textiles, and quantum devices. Organizations like imec are at the forefront of research, developing new materials and processes that expand the capabilities of thin films for applications ranging from wearable sensors to next-generation computing.

As thin-film nanomanufacturing techniques continue to evolve, their impact is expected to broaden, enabling new products and solutions that address global challenges in sustainability, health, and connectivity.

Competitive Analysis: Leading Players, Startups, and M&A Trends

The thin-film nanomanufacturing sector in 2025 is characterized by a dynamic competitive landscape, with established industry leaders, innovative startups, and a robust pattern of mergers and acquisitions (M&A) shaping the market. Major players such as Applied Materials, Inc., Lam Research Corporation, and ASML Holding N.V. continue to dominate the high-volume production of thin-film deposition and patterning equipment, leveraging their extensive R&D capabilities and global supply chains. These companies are investing heavily in next-generation atomic layer deposition (ALD) and molecular layer deposition (MLD) technologies to meet the demands of advanced semiconductor and display manufacturing.

In parallel, a vibrant ecosystem of startups is driving innovation in materials, process control, and flexible substrate applications. Companies such as Oxford Instruments plc and ULVAC, Inc. are notable for their focus on precision instrumentation and vacuum technologies, enabling breakthroughs in organic electronics and energy storage. Startups are also targeting niche applications, including wearable sensors, perovskite solar cells, and transparent conductive films, often collaborating with academic institutions and industry consortia to accelerate commercialization.

M&A activity remains a key strategic lever for growth and technology acquisition. In recent years, leading firms have acquired smaller companies specializing in nanomaterial synthesis, roll-to-roll processing, and in-line metrology to expand their portfolios and address emerging market segments. For example, Applied Materials, Inc. has pursued acquisitions to strengthen its position in advanced packaging and heterogeneous integration, while Lam Research Corporation has focused on expanding its capabilities in atomic-scale manufacturing.

The competitive environment is further influenced by regional policy initiatives and supply chain realignments, particularly in the United States, Europe, and East Asia. Government-backed programs and public-private partnerships are fostering the development of domestic thin-film nanomanufacturing ecosystems, supporting both established players and emerging startups. As the industry moves toward greater integration of artificial intelligence and automation, the ability to rapidly scale novel thin-film processes will be a critical differentiator among competitors.

Regional Dynamics: North America, Europe, Asia-Pacific, and Rest of World

The regional dynamics of thin-film nanomanufacturing in 2025 reflect a complex interplay of technological leadership, investment patterns, and policy frameworks across North America, Europe, Asia-Pacific, and the Rest of the World. Each region brings unique strengths and faces distinct challenges in the development and commercialization of thin-film nanotechnologies.

North America remains a global leader, driven by robust R&D ecosystems and significant investments from both public and private sectors. The United States, in particular, benefits from the presence of major research institutions and industry players such as IBM and Intel Corporation, which are at the forefront of thin-film innovation for electronics, energy, and biomedical applications. Government initiatives, such as those from the U.S. Department of Energy, continue to support advanced manufacturing and nanotechnology research, fostering a competitive environment for startups and established firms alike.

Europe emphasizes sustainability and regulatory compliance, with the European Union’s Green Deal and digitalization strategies shaping the direction of thin-film nanomanufacturing. Leading research centers and companies, including Fraunhofer-Gesellschaft and BASF SE, focus on developing environmentally friendly thin-film processes and materials. Collaborative projects, often funded by the European Commission, promote cross-border innovation and the integration of thin-film technologies into renewable energy, flexible electronics, and smart packaging.

Asia-Pacific is characterized by rapid industrialization and aggressive scaling of thin-film manufacturing capabilities. Countries like China, Japan, and South Korea are home to major electronics and display manufacturers such as Samsung Electronics and LG Corporation, which invest heavily in thin-film R&D for semiconductors, photovoltaics, and advanced displays. Government support, exemplified by initiatives from the Ministry of Science and Technology of the People’s Republic of China, accelerates commercialization and export of thin-film products, making the region a global manufacturing hub.

Rest of the World encompasses emerging markets in Latin America, the Middle East, and Africa, where thin-film nanomanufacturing is in earlier stages of adoption. However, increasing interest in renewable energy and electronics is driving investments and technology transfer, often in partnership with global leaders and organizations such as the United Nations Industrial Development Organization. These regions are poised for growth as infrastructure and expertise develop, particularly in solar energy and low-cost electronics.

Supply Chain and Manufacturing Challenges

Thin-film nanomanufacturing, a cornerstone of advanced electronics, photovoltaics, and flexible devices, faces persistent supply chain and manufacturing challenges as the industry scales in 2025. The complexity of producing high-quality thin films at the nanoscale requires not only precision equipment but also a reliable supply of ultrapure raw materials and specialized chemicals. Disruptions in the global supply chain—exacerbated by geopolitical tensions and logistical bottlenecks—have led to increased lead times and cost volatility for critical inputs such as indium, gallium, and rare earth elements. Companies like 3M Company and Dow Inc. have responded by diversifying supplier bases and investing in local sourcing, but the risk of shortages remains a significant concern.

Manufacturing thin films at the nanoscale also demands stringent process control and contamination management. Even minor impurities can compromise device performance, necessitating cleanroom environments and advanced deposition techniques such as atomic layer deposition (ALD) and molecular beam epitaxy (MBE). Equipment suppliers like Lam Research Corporation and Applied Materials, Inc. are continuously innovating to improve throughput and yield, but the capital intensity of these technologies poses barriers for new entrants and smaller manufacturers.

Another challenge is the integration of thin-film processes with existing semiconductor and electronics manufacturing lines. Compatibility issues, particularly with substrate materials and thermal budgets, can limit the adoption of novel thin-film materials. Industry consortia such as SEMI are working to standardize processes and materials, but the rapid pace of innovation often outstrips the development of universal standards.

Sustainability and environmental regulations are also shaping supply chain strategies. The use of hazardous chemicals and the generation of waste in thin-film production are under increasing scrutiny. Companies are investing in greener chemistries and closed-loop recycling systems to comply with evolving regulations and to meet the expectations of environmentally conscious customers. For example, BASF SE is developing alternative precursors and solvents to reduce the environmental footprint of thin-film manufacturing.

In summary, thin-film nanomanufacturing in 2025 is characterized by a delicate balance between technological advancement and supply chain resilience. Addressing these challenges requires coordinated efforts across the value chain, from material suppliers to equipment manufacturers and end users.

Investment Trends and Funding Landscape

The investment landscape for thin-film nanomanufacturing in 2025 is characterized by robust growth, driven by the expanding applications of thin-film technologies in sectors such as semiconductors, renewable energy, flexible electronics, and advanced coatings. Venture capital and corporate investments are increasingly targeting startups and scale-ups that offer innovative deposition techniques, materials, and process automation solutions. This trend is fueled by the demand for higher efficiency, miniaturization, and sustainability in manufacturing processes.

Major industry players, including Applied Materials, Inc. and Lam Research Corporation, continue to allocate significant R&D budgets toward thin-film process innovation, often collaborating with academic institutions and government research agencies. Public funding initiatives, particularly in the United States, European Union, and East Asia, are supporting pilot projects and infrastructure development to strengthen domestic supply chains and accelerate commercialization. For example, the U.S. Department of Energy has launched programs to advance thin-film photovoltaic manufacturing, while the European Commission is investing in next-generation nanomanufacturing capabilities as part of its digital and green transition strategies.

Private equity and strategic corporate investors are also active, with a focus on companies that enable scalable, cost-effective, and environmentally friendly thin-film production. Notably, investments are flowing into firms developing atomic layer deposition (ALD), chemical vapor deposition (CVD), and roll-to-roll manufacturing platforms, which are critical for high-volume production of flexible displays, sensors, and energy devices. Partnerships between equipment manufacturers and material suppliers, such as those involving ULVAC, Inc. and Oxford Instruments plc, are fostering integrated solutions that appeal to both established manufacturers and emerging market entrants.

Looking ahead, the funding environment is expected to remain dynamic, with increased attention on sustainability metrics, supply chain resilience, and the integration of artificial intelligence in process control. As thin-film nanomanufacturing becomes central to the next wave of technological innovation, the sector is likely to see continued inflows from both public and private sources, supporting a diverse ecosystem of startups, established firms, and collaborative research initiatives.

Regulatory Environment and Standards

The regulatory environment for thin-film nanomanufacturing in 2025 is shaped by evolving standards and oversight mechanisms designed to ensure safety, environmental protection, and product reliability. As thin-film technologies are increasingly integrated into sectors such as electronics, energy, and healthcare, regulatory bodies have intensified their focus on both the materials and processes involved in nanomanufacturing.

Key international standards are developed and maintained by organizations such as the International Organization for Standardization (ISO) and the Institute of Electrical and Electronics Engineers (IEEE). ISO’s Technical Committee 229, for example, addresses nanotechnologies, including terminology, measurement, and health and safety practices relevant to thin-film applications. The IEEE, meanwhile, provides standards for the performance and testing of thin-film devices, particularly in electronics and photovoltaics.

In the United States, the U.S. Environmental Protection Agency (EPA) and the U.S. Food and Drug Administration (FDA) play significant roles in regulating nanomaterials used in thin-film manufacturing, especially where environmental emissions or biomedical applications are concerned. The EPA’s oversight includes the Toxic Substances Control Act (TSCA), which requires manufacturers to report and assess new nanomaterials, while the FDA evaluates the safety and efficacy of thin-film nanomaterials in medical devices and drug delivery systems.

In Europe, the European Chemicals Agency (ECHA) enforces the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation, which mandates detailed risk assessments for nanomaterials, including those used in thin films. The European Commission also supports harmonization of standards and promotes safe innovation through its Nanotechnology Action Plan.

Industry groups such as the SEMI and the Nanotechnology Industries Association (NIA) collaborate with regulators to develop best practices and voluntary guidelines, addressing issues like workplace exposure, waste management, and lifecycle analysis. As the field advances, ongoing dialogue between manufacturers, regulators, and standards bodies is essential to balance innovation with public and environmental safety.

Future Outlook: Disruptive Trends and Strategic Recommendations (2025–2030)

The future of thin-film nanomanufacturing between 2025 and 2030 is poised for significant transformation, driven by disruptive trends in materials science, process innovation, and digital integration. One of the most impactful trends is the rapid adoption of advanced materials, such as two-dimensional (2D) materials and perovskites, which are expected to enhance the performance and versatility of thin films in electronics, photovoltaics, and flexible devices. Companies like Oxford Instruments and Applied Materials, Inc. are investing heavily in research and development to commercialize these next-generation materials for scalable manufacturing.

Automation and artificial intelligence (AI) are set to revolutionize process control and quality assurance in thin-film nanomanufacturing. The integration of AI-driven analytics and machine learning algorithms will enable real-time monitoring, predictive maintenance, and adaptive process optimization, reducing defects and improving yield. Industry leaders such as Lam Research Corporation are already piloting smart manufacturing platforms that leverage big data and digital twins to streamline production workflows.

Sustainability is another critical driver shaping the industry’s future. Regulatory pressures and consumer demand for greener products are pushing manufacturers to adopt eco-friendly deposition techniques, such as atomic layer deposition (ALD) and chemical vapor deposition (CVD) with reduced energy and material consumption. Organizations like SEMI are promoting industry-wide standards and best practices for sustainable nanomanufacturing, encouraging collaboration across the value chain.

Strategically, companies should prioritize investment in R&D partnerships with academic institutions and consortia to stay at the forefront of material and process innovation. Embracing digital transformation—through the adoption of AI, IoT, and advanced analytics—will be essential for maintaining competitiveness. Furthermore, establishing robust supply chain resilience and compliance with evolving environmental regulations will be crucial for long-term success.

In summary, the period from 2025 to 2030 will see thin-film nanomanufacturing shaped by breakthroughs in materials, digitalization, and sustainability. Companies that proactively adapt to these trends and invest in strategic innovation will be best positioned to capitalize on emerging opportunities and navigate the challenges of a rapidly evolving landscape.

Sources & References

- International Business Machines Corporation (IBM)

- imec

- First Solar, Inc.

- Medtronic plc

- The Boeing Company

- ASML Holding N.V.

- Oxford Instruments plc

- ULVAC, Inc.

- Fraunhofer-Gesellschaft

- BASF SE

- European Commission

- LG Corporation

- Ministry of Science and Technology of the People’s Republic of China

- United Nations Industrial Development Organization

- Oxford Instruments plc

- International Organization for Standardization (ISO)

- Institute of Electrical and Electronics Engineers (IEEE)

- European Chemicals Agency (ECHA)